Learn how to participate in Pi Network’s 2024 KYC process and get updates on eligibility, steps, and tips for smooth verification.

Pi Network KYC Updates

Pi Network is a decentralized digital currency project that allows users to mine Pi coins using their smartphones. Launched in 2019, the platform aims to make cryptocurrency more accessible and user-friendly. The Pi Network community has grown exponentially, with millions of users worldwide actively mining Pi through the mobile app.

To ensure the integrity and legitimacy of its users, Pi Network has implemented a Know Your Customer (KYC) process. KYC is a mandatory verification procedure that is crucial for preventing fraud, money laundering, and other illegal activities. As Pi Network moves closer to its full decentralization and mainnet launch, KYC becomes an essential step in the journey. It ensures that only verified users can exchange or transfer their mined Pi coins.

The importance of KYC extends beyond just compliance; it’s a step towards fostering trust within the Pi Network ecosystem. By verifying the identity of its users, Pi Network ensures a secure and authentic platform where members can interact, trade, and mine without concern. This process also brings Pi Network in line with regulatory standards, further solidifying its credibility.

What is Pi Network? A Brief History

Pi Network was founded by a team of Stanford graduates in 2019 with the goal of making cryptocurrency accessible to everyone. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, Pi can be mined using a smartphone, which drastically lowers the barriers to entry. This innovative approach has garnered attention and built a large and dedicated user base.

The platform allows users to mine Pi by simply pressing a button in the app, and the coins are stored in the user’s Pi wallet. This method of mining doesn’t require significant computational power, making it an eco-friendly option for individuals interested in cryptocurrency.

Pi Network is still in its testnet phase, with the mainnet set to launch in the near future. However, the project has already generated substantial buzz due to its innovative approach and the growing community. The platform has positioned itself as a global project, with users from various countries actively participating in mining activities.

One of the key milestones for Pi Network is the introduction of the KYC process. KYC was implemented to ensure that users are verified before they can start utilizing their mined coins for transactions or exchanges. This process helps secure the platform and ensures that the community is protected from fraudulent activities.

Understanding KYC (Know Your Customer)

KYC, or Know Your Customer, is a process that has become an industry standard across many sectors, including banking, finance, and especially in the cryptocurrency market. It is designed to verify the identity of individuals to prevent illegal activities such as money laundering, fraud, and terrorism financing. In simple terms, KYC helps establish the legitimacy of the customer by confirming their identity before they can engage in financial transactions.

In the context of Pi Network, KYC is vital for ensuring that the platform is not misused for illicit activities. It serves as a safeguard to ensure that users are legitimate and that their activities on the platform comply with global regulations. Cryptocurrency projects like Pi Network, which are built on decentralized principles, are particularly vulnerable to fraudulent actors. Therefore, KYC is a crucial mechanism to establish trust and security.

By requiring KYC verification, Pi Network can maintain the integrity of its ecosystem, protecting both users and the platform itself. Moreover, KYC helps foster transparency, ensuring that only verified users are able to access the platform’s features, such as transferring, exchanging, and utilizing Pi coins. This is particularly important as Pi Network moves toward its mainnet launch, where the full value of Pi coins will be realized.

Another advantage of implementing KYC is that it strengthens Pi Network’s legal standing. By complying with international regulations, Pi Network demonstrates its commitment to adhering to the law. As a result, Pi Network’s credibility and acceptance among regulators and investors are greatly enhanced, providing a secure environment for users to engage with the platform.

KYC typically requires users to provide personal information such as their full name, date of birth, address, and identification documents like a passport or driver’s license. This information is then verified through various methods to ensure that the individual is who they claim to be. If discrepancies are found, the verification process is delayed, which can hinder the user’s ability to fully engage with the platform.

Pi Network KYC Updates for 2024

The KYC process in Pi Network has undergone several significant updates in 2024, which have enhanced both the user experience and the platform’s security. These updates reflect Pi Network’s commitment to improving accessibility, transparency, and speed in the verification process.

One major update in 2024 is the introduction of a more sophisticated and user-friendly interface for the KYC process. The previous interface, while functional, was sometimes confusing for users, particularly those who were new to cryptocurrency. The updated version provides clearer instructions, better guidance, and real-time feedback to help users understand each step of the process. This reduces the chances of errors and ensures that users can complete their KYC applications more efficiently.

Additionally, Pi Network has expanded the geographical reach of its KYC process. In 2024, more countries have been added to the list of eligible regions, allowing users from previously excluded countries to now participate in the verification procedure. This global expansion is a sign of Pi Network’s growing presence in the cryptocurrency world and its effort to ensure inclusivity for users from all corners of the globe.

Pi Network has also introduced improved support mechanisms for users going through the KYC process. These include a comprehensive FAQ section, tutorial videos, and a dedicated support team to assist users with any issues they may encounter. This has significantly reduced the number of complaints and delays related to KYC verification, allowing for a smoother experience for everyone involved.

Security has also been a focus of Pi Network’s updates. In 2024, new security protocols were introduced to further safeguard users’ personal data during the KYC process. These protocols include advanced encryption techniques that prevent unauthorized access to sensitive information. Pi Network’s commitment to data protection ensures that users can trust the platform with their personal details, which is essential for the success of the KYC process.

Overall, the KYC updates in 2024 are designed to enhance the user experience, improve efficiency, and reinforce the security and compliance of Pi Network. These improvements play a key role in the platform’s journey towards full decentralization and its long-term success.

How to Complete Pi Network’s KYC in 2024

Completing Pi Network’s KYC process in 2024 is a straightforward procedure, but there are a few important steps users need to follow to ensure that their verification is successful. With the updated system, the process has become more intuitive, providing a smoother experience for users around the world.

Step-by-Step Process:

-

Install the Latest Version of the Pi Network App: Before starting the KYC process, ensure that your Pi Network app is updated to the latest version. You can do this by visiting the Google Play Store or Apple App Store and checking for updates.

-

Log into Your Pi Network Account: Once the app is updated, log into your Pi Network account. You’ll be prompted to enter your credentials, such as your username and password.

-

Navigate to the KYC Section: In the app’s menu, locate the “KYC” section. This is where you will initiate the verification process. It’s important to make sure you’re eligible for KYC before proceeding, as not all users will be able to complete the process immediately.

-

Prepare Your Documents: You will need to submit two key documents: a government-issued ID (such as a passport, national ID card, or driver’s license) and a proof of address document (like a utility bill, bank statement, or tax document). Ensure that these documents are clear, legible, and up-to-date.

-

Upload Your Documents: Once your documents are ready, follow the app’s prompts to upload them. The system will automatically check for clarity and will notify you if there are any issues with the documents.

-

Take a Selfie for Facial Recognition: As part of the KYC process, Pi Network may ask you to take a selfie for facial recognition. This step helps verify that the person submitting the documents is indeed the individual on the government-issued ID.

-

Review and Submit Your Application: Double-check all your details and documents before submitting your application. If everything is correct, click “submit” to send your information for verification.

-

Wait for Approval: After submitting your application, the Pi Network team will review your documents. You will receive notifications within the app regarding the status of your KYC. In most cases, this process takes a few days.

By following these steps and ensuring that all information is accurate, users can complete the KYC process without complications. If any errors are found, Pi Network’s system will provide feedback on what needs to be corrected before resubmitting.

Eligibility for KYC in 2024: Who Can Participate?

Pi Network has specific eligibility requirements that users must meet in order to participate in the KYC process. These criteria are designed to ensure that only legitimate and active users are able to verify their identities and fully engage with the platform.

Eligibility Criteria:

-

Active Participation in Pi Network: To qualify for KYC, users must have been actively participating in the Pi Network ecosystem for a certain amount of time. This ensures that users are not only genuine but also engaged with the platform before attempting to complete KYC.

-

Regional Availability: While Pi Network is a global platform, KYC is being rolled out in phases. Users in some countries may not yet have access to the KYC feature. Users will be notified when KYC becomes available in their region, and they will be able to complete the process once it is accessible.

-

Minimum Age Requirement: Pi Network requires users to be at least 18 years old in order to participate in the KYC process. This is a common regulatory requirement in most countries and ensures that Pi Network complies with age-related legal standards.

-

Correct Profile Information: Before users can complete KYC, they must ensure that their profile information in the app is accurate and up-to-date. If there are discrepancies in the user’s profile (such as a mismatch in the name or address), the KYC process will not proceed until these issues are resolved.

Pi Network aims to ensure that the KYC process is inclusive while also maintaining the integrity of the platform. As more regions become eligible, more users will have the opportunity to participate in the verification process and unlock the full potential of their Pi coins.

Pi Network KYC Verification Process

After submitting your KYC documents, Pi Network’s verification team takes over to review and confirm the provided information. The verification process is essential for ensuring that users’ identities are legitimate and that no fraudulent activities occur within the network.

The Process of Verification:

-

Document Review: Pi Network’s system uses advanced algorithms to check the documents for authenticity. The team ensures that the provided government-issued ID matches the user’s selfie and that the proof of address document is legitimate and corresponds to the user’s details.

-

Facial Recognition: If the user is asked to submit a selfie for verification, the system uses facial recognition technology to compare the selfie with the government-issued ID. This step is critical to prevent identity fraud.

-

System Flags and Review: If any discrepancies are found in the submitted documents or if the system flags any potential issues (e.g., unclear images or mismatched details), the KYC application will be sent for manual review by Pi Network’s verification team.

Once the documents are successfully verified, users are notified through the app. If the verification is rejected, users are informed about the reason and given a chance to resubmit their application.

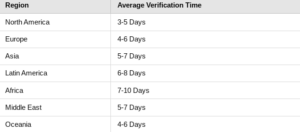

Table: Average KYC Verification Time by Region

Common KYC Issues and How to Fix Them

Despite Pi Network’s efforts to make the KYC process as simple as possible, users may encounter some common issues during verification. Fortunately, these issues can typically be resolved with a few simple steps.

Common Issues:

-

Blurry or Unreadable Documents: If the uploaded documents are blurry or unclear, the KYC system will flag them for review. To fix this, make sure the documents are clear, well-lit, and in focus when uploading.

-

Incorrect Information: If there is a mismatch between the information on the submitted documents and the information in the app, the KYC process will fail. Double-check all personal details (e.g., name, address, and date of birth) before submission.

-

Selfie Mismatch: Sometimes, the selfie does not match the ID due to differences in appearance (such as wearing glasses or different lighting). Make sure to follow the app’s guidelines for taking a clear, accurate selfie.

If any issues arise, Pi Network offers support through its help center, where users can find troubleshooting tips or contact customer service for assistance.

What Happens After KYC is Completed?

Once KYC is successfully completed, users will unlock a variety of features on Pi Network. The completion of the verification process signals that the user is legitimate and can now engage in more advanced features on the platform.

Post-KYC Benefits:

-

Pi Wallet Access: Verified users gain access to their Pi wallets, allowing them to transfer, store, and exchange Pi coins.

-

Eligibility for Mainnet: After KYC, users are eligible for participation in Pi Network’s mainnet launch, which is a crucial step for the network’s decentralization and growth.

-

Enhanced Trust: Completing the KYC process establishes trust in the Pi Network ecosystem, enabling verified users to participate more confidently in the Pi economy.

Pi Network KYC FAQ

1. How long does the KYC process take?

- The KYC verification process usually takes between 3 to 10 days, depending on the region and the volume of applications.

2. Can I reapply if my KYC is rejected?

- Yes, users can correct their details and resubmit their KYC application. Be sure to review the feedback carefully to understand the cause of rejection.

3. Is KYC mandatory for using Pi Network?

- While KYC is not mandatory for mining Pi, it is required for accessing the full features of Pi Network, such as wallet functionality and Pi coin transfers.

4. What documents are required for KYC?

- You will need to provide a government-issued ID and a proof of address (e.g., a utility bill, bank statement, or tax document).

5. Is KYC available globally?

- KYC is gradually being rolled out across various countries. Users will be notified when it becomes available in their region.

The official Pi Network website offers a comprehensive overview of the project, including information about KYC, the mainnet, and the community. It provides helpful articles, updates, and FAQs to guide users through the platform’s features and policies.

Website: https://www.pinetwork.org